How to Register as a Sole Trader: Complete Guide

Starting a business as a sole trader in the UK is a straightforward process that offers flexibility and control. This comprehensive guide provides updated information on registering as a sole trader, incorporating recent changes and best practices.

1. Understanding the Sole Trader Structure

A sole trader is an individual who runs their own business and is self-employed. This structure is the simplest form of business in the UK, where the owner has complete control and is personally responsible for the business’s debts.

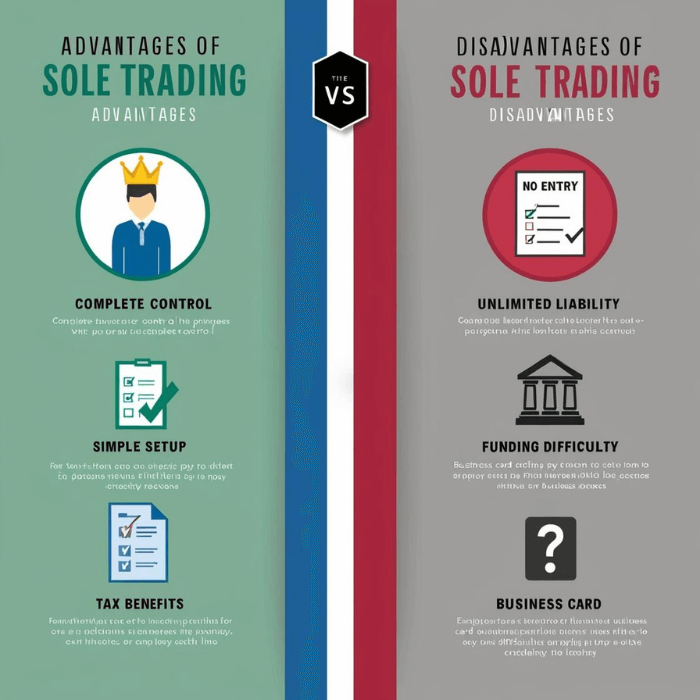

2. Advantages and Disadvantages of Being a Sole Trader

Advantages:

- Full Control: You make all business decisions independently.

- Simple Setup: The registration process is straightforward and cost-effective.

- Tax Benefits: Simplified taxation through self-assessment.

Disadvantages:

- Unlimited Liability: Personal assets are at risk if the business incurs debts.

- Funding Challenges: Raising capital can be more difficult compared to other business structures.

- Perceived Credibility: Some clients or suppliers may prefer dealing with limited companies.

3. Eligibility Criteria for Registering as a Sole Trader

To register as a sole trader in the UK, you must:

- Be a UK Resident: You should reside in the United Kingdom.

- Have a National Insurance Number: This is required for tax and National Insurance purposes.

4. Choosing a Business Name

When selecting a business name:

- Uniqueness: Ensure the name isn’t already in use or trademarked.

- Compliance: Avoid using sensitive words or expressions without permission.

- Professionalism: Choose a name that reflects your business ethos and is easy to remember.

5. Registering as a Sole Trader with HMRC

When to Register:

You must register as a sole trader if you earned more than £1,000 from self-employment between 6 April of one year and 5 April of the next.

How to Register:

- Online Registration:

- Visit the GOV.UK website and register for Self Assessment.

- Provide your National Insurance number and personal details.

- After registration, you’ll receive a Unique Taxpayer Reference (UTR) number by post within 10 working days.

- By Phone or Post:

- If you cannot register online, contact HMRC for assistance.

Note: Registering late or failing to register may result in penalties.

6. Understanding Tax Obligations

Income Tax:

- Personal Allowance: The standard tax-free personal allowance is £12,570.

- Basic Rate: 20% on income between £12,571 and £50,270.

- Higher Rate: 40% on income between £50,271 and £125,140.

- Additional Rate: 45% on income over £125,140.

National Insurance Contributions (NICs):

- Class 2 NICs: £3.45 per week if your profits are £6,725 or more.

- Class 4 NICs: 9% on profits between £12,570 and £50,270, and 2% on profits over £50,270.

Self-Assessment Tax Returns:

- Filing Deadline: 31 January each year for the previous tax year.

- Payment Deadlines: 31 January (balancing payment) and 31 July (payment on account).

7. Keeping Financial Records

Maintaining accurate records is crucial for:

- Tax Returns: Ensuring correct tax calculations.

- Financial Planning: Monitoring business performance.

- Legal Compliance: Meeting HMRC requirements.

Records to Keep:

- Sales and Income: Invoices, receipts, and bank statements.

- Expenses: Receipts for business purchases and costs.

- VAT Records: If registered for VAT.

Recommended Tools:

- Accounting Software: Xero, QuickBooks, or FreeAgent.

- Spreadsheets: For manual record-keeping.

8. Setting Up a Business Bank Account

While not legally required, having a separate business bank account helps:

- Financial Clarity: Separates personal and business finances.

- Professionalism: Enhances credibility with clients and suppliers.

- Accounting Efficiency: Simplifies bookkeeping and tax returns.

Popular Business Bank Accounts:

- Traditional Banks: Barclays, Lloyds, HSBC.

- Challenger Banks: Starling Bank, Monzo Business.

9. Registering for VAT (If Applicable)

When to Register:

You must register for VAT if your taxable turnover exceeds £85,000 in a 12-month period.

FAQs

1. How long does it take to register as a sole trader?

- Registration is immediate, but the UTR number arrives in 10 days.

2. Do I need an accountant?

- Not mandatory, but helpful for tax returns.

3. Can I change from a sole trader to a limited company later?

- Yes, you can transition to a limited company if needed.

4. Do I need to register for VAT as a sole trader?

- Only if turnover exceeds £90,000 per year.

5. Can a sole trader have a business partner?

- No, but you can form a partnership instead.

Also Read: How to Set Up a Business Partnership in the UK

Source / Ref.: Gov.uk Contains public sector information licensed under OGL v3.0.